million dollar whole life insurance policy cost

The best whole life insurance rates you can get will depend on your age health lifestyle and how long you plan to pay premiums. For a 20-year policy a healthy non-smoker might pay.

:max_bytes(150000):strip_icc()/dotdash-ife-insurance-vs-ira-retirement-saving-Final-464e7c3711bb488d880a37c09bc0c55d.jpg)

Ira Vs Life Insurance For Retirement Saving What S The Difference

Securing a 10 million 10000000 life insurance policy at.

. 10 years 20 years and 30 years 5 million term life insurance rates are based on a male nonsmoker in excellent health. A 2 million whole life insurance policy will usually be 5-10x more per month which is cost prohibitive for many families. Buying a million-dollar life insurance policy is the goal.

This depends on the type of insurance you buy your age and other risk. A 1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. 5-million life insurance can cost.

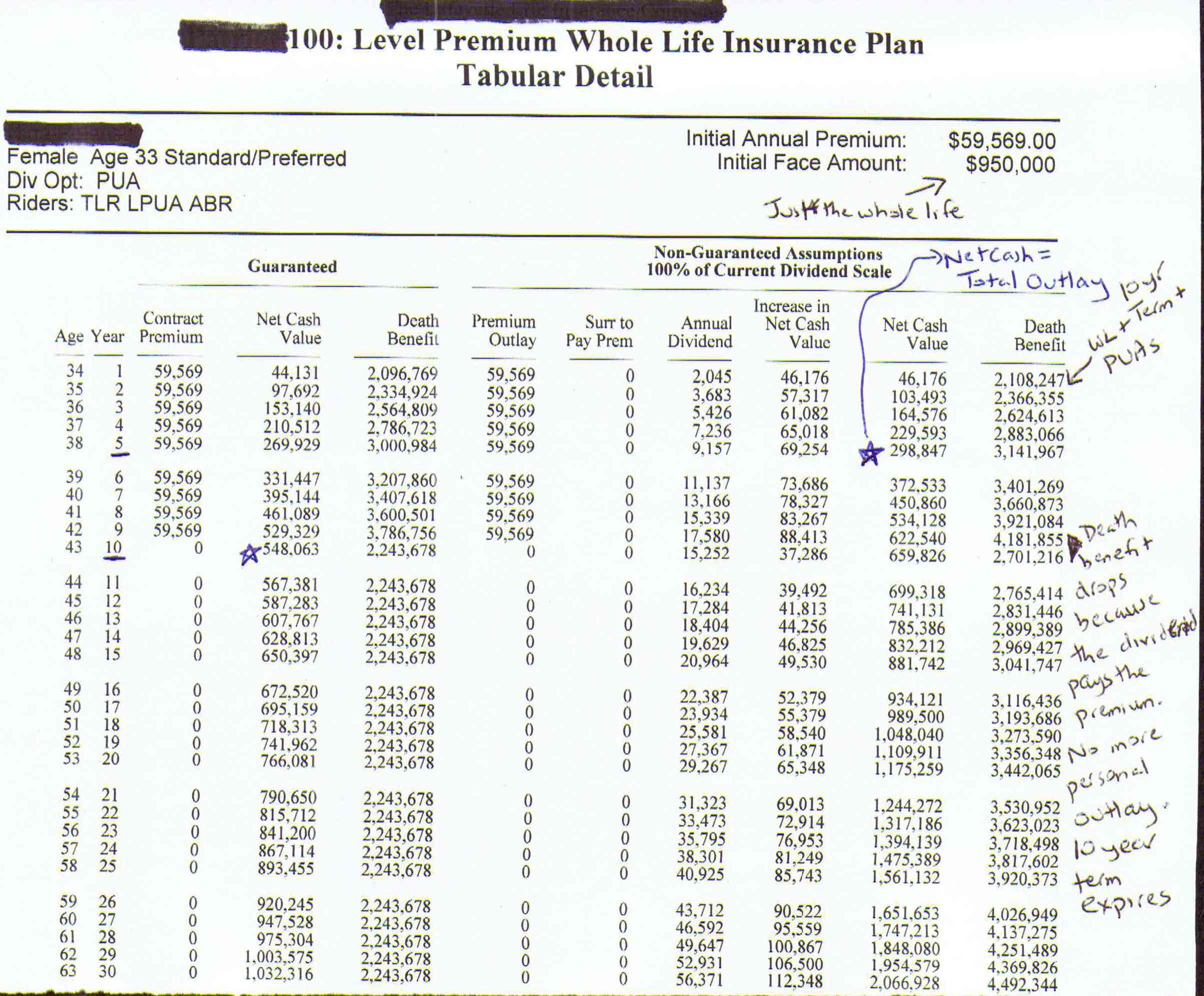

2940 in annual premium for 20-year term life insurance. Its important to understand some things about permanent life. In this article we will look at how much a 1 million dollar permanent life life insurance policy costs.

Still the earlier you get your start the more money youll save. A 10-year 2000000 life insurance policy for 32 per month. A 40-year-old non-smoking female can pay under.

The short answer is that it depends on the type of life insurance policy. 10 million 10000000 life insurance policy-wrap up. According to internal Policygenius data a 35.

He can save money and still maintain good life insurance protection by buying the following policies. A 1 million life insurance can cost you from 30 to 50 per month depending on the number of years in your plan. 100 Million Dollar Life Insurance Policy Cost For A Male.

Below are the rates for 100000000 life insurance policy for Term Universal Life and Whole Life. For example as of 2021 a life insurance quote for a 1 million RAPID ecision Life policy from Fidelity. In fact most Americans think a term life policy costs triple or more the actual cost.

A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays 1000000 of life insurance. 10 million dollar whole life insurance policy cost. A million-dollar whole life policy often costs 800 a month or more even if you purchase the policy young.

Typically the monthly cost is five to 10 times more. How much a month is a million dollar life insurance policy. A 1 million life insurance policy can cost anywhere from few hundred to thousands of dollars.

By comparison you might be able to get a million-dollar term. The cost of a million-dollar life insurance policy varies based on your age health and other risk factors. A 2 million life insurance policy may sound like a lot and you might think so much coverage must be very expensive.

And in this article we will actually provide some million-dollar whole life insurance policy quotes and at the same time break down what makes a whole life policy good and bad plus. But if you have the means to qualify for 10 million in coverage you can likely afford the premiums.

5 Best Whole Life Insurance Companies Of 2022 Money

5 Best Whole Life Insurance Companies Of 2022 Money

What Are Paid Up Additions Pua In Life Insurance

Million Dollar Life Insurance Policy In 3 Easy Steps

How Much Is Life Insurance In Canada Average Costs Policyme

How Much Does A Million Dollar Life Insurance Policy Cost Forbes Advisor

Dividend Paying Whole Life Insurance The Alternative Fixed Income Vehicle Part 3 Seeking Alpha

How Much Does A Million Dollar Life Insurance Policy Cost

How Much Does A Million Dollar Life Insurance Policy Cost

The Ultimate Guide To Million Dollar Life Insurance Policy Cost

/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of 2022

Million Dollar Life Insurance Policy Find An Agent Trusted Choice

2022 Final Expense Insurance Guide Costs For Seniors

The True Cost Of A One Million Dollar Life Insurance Policy Fidelity Life

How To Buy A 1 Million Life Insurance Policy And When You Need It

Buy A Million Dollar Life Insurance Policy For Cheap From 15 Month

Life Insurance Policy Loans Tax Rules And Risks